One of my students sent along an telling tale from Spain. It seems that when times get tough enough, 26% unemployment in the case of Spain, people become incredibly resourceful. Continue reading When Times Get Tough

Category: Public Policy, Economics and Entrepreneurship

Small Business Owners Still in Recession Frame of Mind

September was another month of low expectations and pessimism for the small-business community, with the NFIB Small Business Optimism Index losing 0.1 points and falling to 92.8. The recession-level reading was pulled down by a deterioration in labor market indicators, with job creation plans plunging 6 points, job openings falling one point and more firms reporting decreases in employment than those reporting increases in employment.

The survey shows that key elements that will be needed for small businesses to, once again, help pull us out of a recession are just not improving: Continue reading Small Business Owners Still in Recession Frame of Mind

May Updates on Small Business Economy

While April showers have brought wonderful May flowers in our backyard, entrepreneurial economy is not blossoming going into the summer.

Here are some highlights from various indicators:

- 71 percent of small business owners still believe the United States economy is in a recession according to results of the 2012 U.S. Bank Small Business Annual Survey

- The SurePayroll Scorecard data shows that month-over-month, hiring and paycheck size show little change, both down 0.1%, while year-over-year, hiring is down 1.5% and paychecks are down 1.1%. Optimism among small business owners is also down from last month.

- Intuit’s Small Business Revenue Index shows that revenues have been growing slowly, while their Small Business Employment Index shows that employment is growing slowly, by 0.2 percent in May.

- Data from nominees to Ernst & Young’s Entrepreneur of the Year program, shows that over the last two years employment growth in this select group of high-growth companies was 31% job growth. While this sounds promising, these businesses are hard-wired for growth, so in many ways these figures are not as robust as I would hope to see.

- William C. Dunkelberg at NFIB said this today about their latest small business survey, “May was a stagnant month for employment in the small-business sector, with the net change in employment per firm, seasonally adjusted coming in at ‘0’.”

Small Businesses Still not Hiring

It is getting to be a broken record — we need small businesses to lead us into a real recovery that is based on job growth, but small businesses are just not ready to increase their workforces.

Two job indexes released this week show mixed results.

SurePayroll Scorecard data shows that month-over-month, hiring is down -0.1% and average paychecks are down 0.3%. Looking at this year compared to 2011 at the same time, hiring is down 1.3% and paychecks are down 1.3%.

The same survey showed a drop in optimism among small business owners to 65%, down from last month’s 70% finding.

Like the recent NFIB surveys, those small businesses looking to hire are finding it a challenge, particularly when it comes to finding qualified technology, sales/marketing, customer service, administrative workers.

The Intuit Small Business Employment Index shows that small business employment increased slightly — 0.2 in April.

Taken together it paints a familiar picture — no recovery led by small businesses is visible at this time.

All Signs Show Continued Weakness in Job Creation

It looks like a continuation of a weak economy is likely for at least the rest of 2012. We know from previous surveys that weak demand is what is holding businesses back from hiring. It appears that a turnaround is not in our immediate future.

There were some signs of hope in March’s employment numbers. Intuit Small Business Employment Index showed modest growth in jobs. And the latest survey from the NFIB also showed some improvement in March. One exception to these surveys was SurePayroll’s Small Business Scorecard, which showed no job growth in March.

While there has been evidence of modest improvement in job creation over the past few months, the outlook is not good for any continuation of job growth in the economy. It appears that any improvement may have been short-lived and not sustainable.

“March came in like a lion, with Main Street seeing significant job growth in March—but it appears to have gone out like a lamb, and with no cheer in the forward-looking labor market indicators. What could have been a trend in job growth is more likely a blip,” said NFIB Chief Economist Bill Dunkelberg. “And what looked like the start of a recovery in profits fizzled out. The mood of owners is subdued—they just can’t seem to shake off the uncertainties out there, and confidence that the management team in Washington can deal with the effectively is flagging. What we saw in March is painfully familiar – this was the same pattern of growth followed by months of decline from 2011. History appears to be repeating itself—and not in a good way.”

An additional concern in the NFIB survey is that those small business owners who do want to hire, are having difficulty in finding qualified workers. Among the entrepreneurs we work with, the specific shortage is in technology workers.

So what do we hear from policy makers in Washington? They continue to treat the current situation as if it is simply a shortage of capital. The latest attempt to pump money into the system comes from the “Jobs Act.” This legislation is an attempt to open up capital markets to support entrepreneurial ventures to a broader group of investors. (NOTE: The devil is in the details regarding any impact on this new law as the SEC has yet to write the rules. Stay tuned, as the actually implementation of this bill will likely be very different than advertised by the politicians who passed it).

But even if the Jobs Act was implement as promised, it does not solve the real problem in our economy. As Ami Kassar rightly points out, this bill plays into the myth of what kind of entrepreneurial activity really grows an economy. This is a bill that plays well in Silicon Valley, but probably will have little or no impact on Main Street. Kassar argues:

In my opinion, the last thing these main street entrepreneurs need is crowdfunding (passed in the Jobs Act today). The first thing an entrepreneur should do is try to figure out how to execute their business model without selling off shares to investors. After all, the investors never go away in their company.

We should be encouraging our entrepreneurs to bootstrap their ventures. We should be doing everything in our power to open up lines of credit and loans at reasonable prices to small business owners. We should be doubling down on efforts like SCORE and / or the SBDC’s to provide mentorship.

And we need to leave more money in the pockets of the consumers who do have jobs and in the bank accounts of the small business owners struggling to sustain their businesses through this prolonged recession. Government is never an efficient nor an effective middle man for economic growth. Let’s keep more of the money people are earning in their wallets so they can begin to spend more of it on Main Street.

Some Trends for 2012

So what can small businesses expect for 2012? My general advise continues to be cautious! While we are seeing some of the small business surveys showing optimism increasing and more importantly employment improving slightly, I worry that we have been lulled into a mode of thinking that the worst is over.

I believe that we are simply in the eye of the storm. I hope that the storm is dissipating, but I fear that the back wall of the eye will hit us sometime later this year. It may come as a result of the European debt crisis or it may come as a result of the looming Chinese credit crisis, but I fear it may hit us and his us hard.

That being said, we do need to get on with life. Things may actually improve, but even if they don’t the vast majority of small businesses will survive even if things get nasty.

Steve Strauss offers his take on trends for small businesses to watch at Business on Main. He sees mobile mania continuing to surge this year, a continued increase in the solopreneur (a.k.a., free-lancers, independent contractors), and an improvement in how Groupon works with small businesses.

He also is keeping on eye on the economy and has some concerns about the impact of the fall election.

It is a thoughtful article that is worth a careful read as you make your plans for this year.

Millennial Entrepreneurs Waiting in the Wings

Based on the history of previous economic downturns, America’s entrepreneurs will need to play a key role in helping to rebuild our economy.

So, just what is the current mindset and makeup of those in the entrepreneurial sector of the U.S. economy?

Even in a weak economy, or quite possibly because of it, there continues to be a strong interest among the millennial generation in pursuing an entrepreneurial career.

A recent survey of young Americans between the ages of 18 and 34 conducted by the Kauffman Foundation found that 54 percent of those surveyed have entrepreneurial aspirations, and about half of these have already launched a business.

An even higher percentage of young people of color — 64 percent of Latinos and 63 percent of African-Americans — expressed a desire to start their own companies. Although some previous studies have found an increased interest in business ownership among women, the Kauffman study found that women still lag in entrepreneurial intent (44 percent compared to 57 percent among men).

Given that there are an estimated 50 million millennials in the U.S., their interest in launching new businesses bodes well for the long-term health of the economy.

What we are finding is that not all of them are in it simply for the money.

The Global Entrepreneurship Monitor (GEM) 2010 National Entrepreneurial Assessment for the USA, conducted by Babson College and Baruch College, found that startup entrepreneurs are increasingly focused on both social and economic goals for their businesses.

Entrepreneurs no longer just want to do well financially with their ventures, but also want to use business as a means to support their commitment to their favorite social causes.

This shift in how small business owners measure their success is also evident in the results of The Hartford’s recent Small Business Success Study. This survey found that only 18 percent say that profitability is the most important factor in defining success. In fact, 82 percent say they place great importance on doing something they feel passionate about and enjoy.

A growing number of entrepreneurs are interested in keeping balance in their lives. The Hartford survey reported that for 79 percent of the entrepreneurs they surveyed, achieving a comfortable lifestyle from their business is most important to them.

There is a growing chorus of experts who are worried that entrepreneurs do not seem ready or willing to step forward and provide the economic push we need to begin a real economic recovery.

However, the good news is that the generation now coming into the workforce has a strong entrepreneurial spirit. That should help to eventually create long-term, sustainable growth for America.

What is it with Economists and Small Business?

I have been rebutting Scott Shane’s maligning of small business in the economy in this blog for some time. Prof. Shane is an economist who teaches entrepreneurship at Case Western Reserve U. (You can see those posts here, here, here, here, here and here).

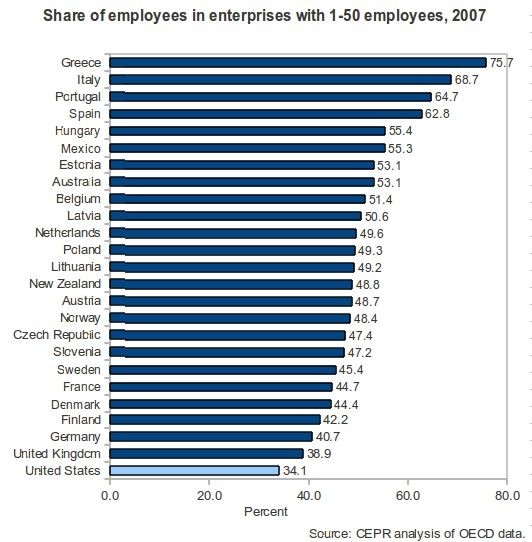

Now we have a post at the Economist blog, Free Exchange, that examines the role of small business as an engine of jobs in the U.S. economy. They start with this graph:

“Entrepreneurs boost the economy by exploiting new ideas and business

models in order to turn a profit. The ones that do this well don’t stay

small; they grow rapidly, helping to disseminate new technologies and

create jobs. If your economy has a lot of small firms, that’s an

indication that some part of this process is broken. If you look at the

Italian example, for instance, you find that a lot of small Italian

firms are retail and service enterprises protected from competition by

onerous regulation.”

I guess economists can’t help themselves. It may seem that they disdain small businesses, but it may just be how they get trained to think. Classic economic theory never has really had a place for small business.

I studied economics at undergraduate level (a minor), MBA level (applied econ), and doctoral level (in my DBA program had to take the same two intro PhD Econ courses as Economics PhD”s did), so I have a sense of where this comes from.

Economists view commerce as a place where small businesses compete again each other. The strong beat out the other small firms and become larger. Then the larger compete against each other and the largest win and get to be really big monopolies. It is a static model that for the most part minimizes disruptive innovation, or as we like to call it, entrepreneurship. It is also a view that takes out the emotional and psychological aspects of entrepreneurship — passion, risk tolerance, ethics, values, life/work balance, and so forth.

Their world view is one of only purely rational economic goals. Entrepreneurs start ventures for so many more reasons that that. We want to create jobs, build a certain kind of culture, find safe and cool niches to operate in profitably, etc., etc. etc. It is rarely to simply maximize shareholder’s wealth (our own in this case).

To do so impinges on our other goals, exposes us to outside funding requirements that are just not worth the hassle (i.e., banks and their personal guarantees and venture capitalists and their term sheets), and can just plain take the fun out of owning and running a business.

And by the way — this analysis is based on about seven decades of a very different economy that was dominated by large firms. That economy stopped creating jobs back in the 1980s. Most research shows that entrepreneurs created about 75-80% of all new jobs from about mid 1980s up until the Great Recession began in 2008.

The good news is that most of the time economists just talk to other economists.

Jobs not Improving in Small Business Sector After All

There are some recent reports suggesting that small businesses may be getting in a hiring mood. Not so, says the latest survey of small business owners by the NFIB that is about to be released.

“We wish there was good news to report, says William C. Dunkelberg, chief economist for the NFIB. “But sadly, we will give you more of the same: The prospects for a good jobs report are dim. In August, small-business owners reported job losses averaging .08 workers per firm over the last three months. This follows a loss of .23 workers per firm reported in June and .15 workers per firm in July.”

Dunkelberg tries to add a glimmer of hope by adding, “The good news is that the trend is moving in the right direction–losses appear to be decreasing.”

However, he goes on to point out that the change doesn’t seem to be moving fast enough to close the employment void we’ve been experiencing for the last several years.

“While the readings remain historically weak, we can find a grain of encouragement as we look at hiring prospects. Over the next three months, 11 percent plan to increase employment (up 1 point), and 12 percent plan to reduce their workforce (also up 1 point), yielding a seasonally adjusted net 5 percent of owners planning to create new jobs, which is a 3 point improvement over July. But, let’s not get ahead of ourselves,” cautions Dunkelberg.

That is good advice, since we have seen small business owners appear hopeful of future hiring in previous months, only to be disappointed.

So the bottom line is that the employment picture is largely unchanged.

Those on Wall Street are not Alone Wringing their Hands

Small business owners on Main Street are joining investors on Wall Street in worrying where the economy is headed, according to the latest survey from the NFIB.

For the fifth consecutive month, NFIB’s monthly Small-Business Optimism Index fell, dropping 0.9 points in July–a larger decline than in each of the previous three months–and bringing the Index down to 89.9. This is below the average Index reading of 90.2 for the last two-year period. Put simply, they are losing what little optimism they had been building during what had been hyped as the beginning of a recovery. They now fear that there really was no recovery after all and more bad times are likely ahead.

Expectations for future real sales growth and improved business conditions were the major contributors to the decline in optimism. Remember that this survey was completed before the events of the last two weeks.

“Given the current political climate, the protracted debate over how to handle the nation’s debt and spending, and the now this latest development of the debt downgrade, expectations for growth are low and uncertainty is great,” said NFIB Chief Economist Bill Dunkelberg. “And considering the confidence-draining performance of policy makers, there is little hope that Washington will stop hemorrhaging money and put spending back on a sustainable course. Perhaps we might begin referring to the ‘Small-Business Pessimism Index’ from now on.”

Indeed.

I am hearing economists who had been hopeful for our economy to muddle along and grow ever so slightly changing their tune. More and more are talking “double dip”. Since I do not agree that a true recovery has ever really taken root, I prefer to call it a “second plunge.”

“And what should the government do now?”

That is the wrong question to frame the debate. It is what the government has done over the past two administrations that has magnified the problems in our economy.

Governments cannot create a sustained economic expansion through spending and monetary policy.

Businesses and their customers do that. Stop bleeding them of their money and get out of their way.